Greenwashing or true impact? Not all RECs are created equal

How can companies maximize the impact of their dollars in accelerating the transition to renewable energy? Is additionality relevant or is that just for carbon offsets?

Sep 20, 2022

The importance and challenge of getting to net-zero emissions

To address climate change, we need to rapidly transition to renewable energy. Government action, including the recently passed Inflation Reduction Act, is critical to our success but not enough on its own.

Companies will continue to play a big role in accelerating the decarbonization of our economy. And more companies are stepping up. Since the founding of the Science Based Targets initiative in 2015, the number of companies with net-zero commitments has more than doubled every year.

However, setting net-zero goals is far easier than achieving them. Companies have to navigate numerous options and become experts in fields unrelated to their core business so they don’t waste their money protecting forests that weren’t at risk or supporting renewable energy projects that didn’t need support.

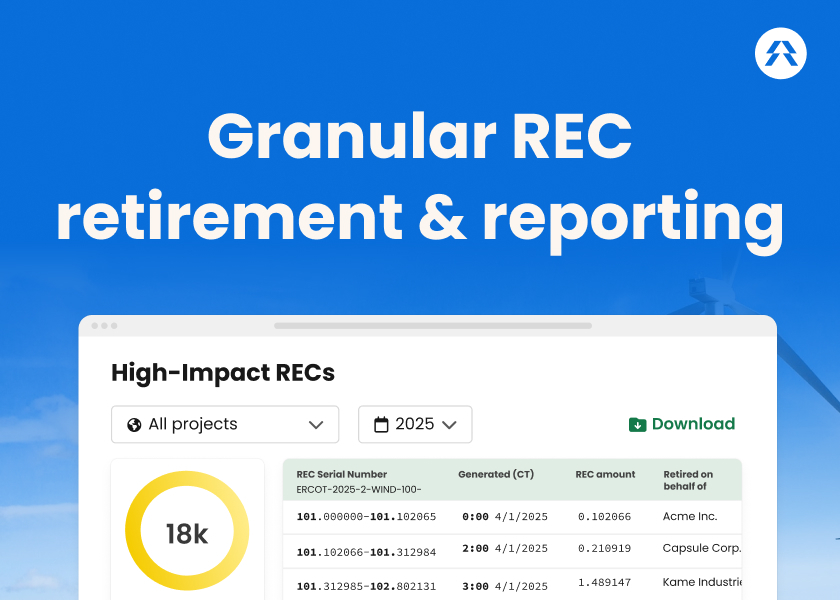

At Ever.green, we are focused on the transition to renewable energy which mostly falls in a company’s scope 2 emissions (emissions from the purchase of electricity). The primary tool used to address scope 2 emissions are Renewable Energy Certificates (RECs), which are credits issued by grid operators to track energy generated by solar, wind, or other clean energy sources. In 2020, over 110,000 companies bought RECs in the US and Canada to address their goals for 100% renewable energy.

But not all RECs are created equal.

PART 1: THE PROBLEM

Why most RECs don’t help achieve net-zero emissions

For every megawatt-hour (MWh) of clean energy delivered, one REC is issued to the electricity generator. They can be (and usually are) unbundled from the energy itself and sold separately.

RECs have worked well in compliance markets where they are used to track a state’s progress towards achieving a certain percentage of clean energy by a certain date.

But actual growth in building renewables has been outpacing these goals since 2007. And every MWh of clean energy generated beyond the goals results in a REC available in the voluntary market, where they can be bought by end-use consumers such as companies, utilities, and individuals anywhere in the US or Canada.

The theory was that enough aggregate demand in the voluntary market would drive up prices for RECs, spurring future development of renewables over the long-term.

The reality is that increases in REC supply continue to outstrip demand in the voluntary market, keeping REC prices low. As research studies have confirmed, it is hard to see how RECs purchased for a few dollars each are causing more projects to be built:

- Renewable energy certificates threaten the integrity of corporate science-based targets. Bjorn, Lloyd, Brander, and Matthews (2022). Nature Climate Change.

- Creative accounting: A critical perspective on the market-based method for reporting purchased electricity (scope 2) emissions. Brander, Gillenwater, and Ascui (2018). Energy Policy.

- Contribution of green labels in electricity retail markets to fostering renewable energy. Mulder and Zomer (2016). Energy Policy.

- Additionality of wind energy investments in the US voluntary green power market. Gillenwater, Lu, and Fischlein (2014). Renewable Energy.

- And many more

This dynamic is also acknowledged by the standards bodies and protocols on which the market and government entities rely on:

Greenhouse Gas Protocol Scope 2 guidelines, state on page 90:

“Individual voluntary purchases and consumer programs may or may not result in changes in low-carbon supply, depending on supply and demand dynamics. For instance, one paper [1] suggests that the voluntary REC market in the U.S., when evaluated based on the price of RECs as an incentive for project developers, has not itself driven new renewable energy projects.”

Green-e Code of Conduct state on page 29:

“Participants may make statements about avoided grid GHG emissions in association with the renewable energy generation or the supply used for the renewable energy product. However, they must not imply a causal link between the purchase of renewable energy and avoided emissions (i.e. that purchases result in generation or avoided grid emissions).”

In a letter to the SEC regarding proposed climate disclosures, Center for Resource Solutions (Green-e’s parent company) asked the SEC to:

“remove references to RECs as a strategy or solution specifically to achieve net emissions reductions and where it is either stated or implied that RECs are used for net adjustments to gross emissions.”

Other experts like the GHG Management Institute say it more bluntly. When answering the question, “Should I use RECs to support my claims of ‘carbon neutrality’ or ‘net zero’?,” they answer:

“No, it has been established that the voluntary markets for RECs do not influence investments in renewable energy generation capacity, nor do they induce greater energy output from existing renewable generation capacity. They, therefore, cause no emission reductions.”

PART 2: THE SOLUTION

RECs CAN make a big impact if you test for additionality

Unlike these low-impact RECs, RECs bought via long-term contracts and signed directly with the project before it’s financed or built can make a proposed project viable.

This too is recognized by the Greenhouse Gas Protocol:

“Market analysis [2] indicates that the effect of voluntary demand on new renewable energy project development is not based on the price of those RECs so much as it is on the presence of long-term contracts for RECs and energy from projects as yet unbuilt.”

– Greenhouse Gas Protocol Scope 2 guidelines, p90, 2015

These long-term contracts for RECs on unbuilt projects can be tested to show they made something happen that wouldn’t have happened otherwise.

What is additionality and is it appropriate for RECs?

Additionality means proving that a company’s purchase of carbon offsets or signing of a long-term contract for RECs caused something to happen that wouldn’t have happened otherwise.

Or as John Oliver put it in his recent segment on carbon offsets, "An offset should provide an extra reduction of carbon that wouldn't have happened any other way."

Historically, additionality has only been applied to carbon offsets which are sold on the basis of a verifiable, quantifiable, permanent, and additional avoidance of emissions.

The Greenhouse Gas Protocol described additionality and its relevance with RECs in their training webinar (at the 1:05:25 mark) as follows:

“Additionality is a very relevant concept for thinking about how to drive change in an electricity system overall or wanting to ensure your voluntary activities are indeed pushing for greater change but it’s not a specific requirement for RECs. In other words, you can buy certificates and they can represent renewable energy [from a project] that was on the grid 10 years ago or renewable energy that came on because of a specific project that you helped make happen. There is no explicit distinction or requirement for [RECs] because the information they are conveying is more neutral, just attributes from energy generation which are true no matter the reasons for the project happening.”

Companies do want to drive change. They see the need to accelerate the transition to renewable energy and want to use their position in the market to make that happen. And that can’t be done without testing for additionality.

So why isn’t everyone signing a long-term contract?

Less than 1% of companies that use RECs to reduce their scope 2 emissions procure them via long-term contracts on new projects.

Instead, most companies buy RECs each year in spot markets via a broker, sourced from a pre-existing project. This is because, for most companies, these long-term contracts are too long, for too much energy, and too complex and risky.

One of the most common types of long-term contracts is a Virtual Power Purchase Agreement (VPPA). In this contract, the sponsoring company takes on the risk of the project in a wholesale energy market and can even make money in some years. But that risk is a major issue for any company that isn’t big enough to have a robust procurement team with expertise in energy markets.

Ever.green’s fixed-price VPPA addresses these issues and makes these impactful long-term contracts accessible to companies of all sizes. It is custom-fit to each customer and removes the risk of a traditional VPPA all while ensuring each contract has the intended impact in making new projects possible.

How projects benefit the planet

Once we establish a company’s true impact on making a renewable energy project happen, it’s valuable to better understand the impact the project has on the planet.

Here again, every REC is seen as equal in the market, while we know that the impact of adding a MWh of clean energy is variable for different projects, in different locations, at different times. For example, a REC in Texas, where coal is significant, will have greater climate impact than a REC in New York, where hydroelectric power is the predominant energy source.

To more effectively ensure our high bar is met, Ever.green has developed a scorecard to assess the impact of solar projects on the climate, environment, and community. We set an ambitious minimum requirement for responsible development and outline ways to maximize the positive impact on the climate and community while minimizing any harm on the environment, land, and wildlife.

You can find our framework here, and we’ll continue to iterate and improve it with our partners and customers.

Let’s build some solar!

Not all RECs are equal in their impact on projects and not all projects are equal in their impact on the planet. By engaging in long-term contracts and holding project developers to high standards, companies can cause more projects to be built and truly accelerate the transition to renewable energy.

If that’s as exciting to you as it is to us, check out www.ever.green to learn more or reach out at hello@ever.green. Let’s build some solar!